Fear is Your Worst Enemy – Especially in Real Estate!

You are bigger than your self-doubt.

Remind yourself of that each and every day. - Caroline Ghosn

When it comes to important decisions,

doubting yourself can be your worst enemy... from over thinking, over

analyzing to second-guessing. It's as if you become the prosecutor

and defense counsel at the same time in a bad lawyer movie.

Self-doubting happens in all walks of

life, from goal setting, to personal relationships, even in real

estate.

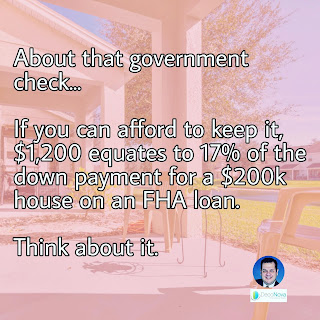

One example I can tell you about is

when folks think their credit is not good enough to buy, or when they

think they need 20% of the purchase price as down payment. If you

credit score is good enough, you can qualify to purchase a home with

very little upfront money. FHA loans require only 3.5% down rather

than 20%.

When it comes to credit scrores, you

may be in for a positive surprise. First, technology allows you to

see your credit scores easily using services such as Credit Karma.

Some banks provide credit score information for free as an added

service for their cardholders. You can also dispute incorrect entries

easily, right from your phone or computer.

Back in September 2019, CNBC reported

that for the first time, the average national credit score has

reached 706, according to FICO, the developer of one of the most

commonly used scores by lenders. Yes, if the average American has a

706 credit score, so can you!

Better yet, you don't even need to be

average to qualify for a loan. With a 580 score, you can qualify for

FHA financing, albeit with higher costs and interest rates. Once you

hit 640, you qualify for most first time homebuyer programs. As you

go up in the credit scale, you chime in additional savings in the

form of a better interest rate.

My advice to you: check your credit

scores. If you find incorrect information, dispute it right away. If

your score is not good enough, start working on it. It may take a few

months, but an influx of new positive accounts should help.

Don't let fear limit you. Even if your

credit was horrible a few years ago, you can change that fairly

quickly and get yourself on the path to homeownership.

Also: if your credit is good enough,

let's start a conversation about your homeownership goals. We will

follow that with a pre-qualification through a competent loan

officer, so you can find out how much home you can afford.

Call me at (407) 443-3833 or visit my page at www.MiltonTheRealtor.com for more information.

* - Don't forget to connect with me on LinkedIn, Facebook (English and Spanish) and Twitter!

* - Don't forget to connect with me on LinkedIn, Facebook (English and Spanish) and Twitter!

Comments

Post a Comment